PCI-DSS is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

The PCI-DSS is maintained by the Payment Card Industry Security Standards Council, which is made up of major credit cards companies such as Visa, MasterCard, American Express, Discover, and JCB. The standard includes requirements for network security, physical security, data protection, access control, and more.

The goal of PCI-DSS is to reduce the risk of credit card fraud and protect sensitive cardholder data. Compliance with the standard is required for all merchants that accept credit card payments, and non-compliance can result in fines and other penalties.

The Importance of PCI-DSS

As an international standard with a primary objective of ensuring the protection of cardholder data against potential misuse or theft. For organizations handling payment card transactions, complying with PCI-DSS is essential to stay in business.

To stay compliant, PCI-DSS requires its subjects to:

- Track and monitor all access to network resources and cardholder data

- Secure audit trails so they cannot be altered.

- Regularly test security systems and processes.

- Deploy file integrity monitoring tools to alert personnel to unauthorized modification of critical system files, configuration files or content files.

- Configure the software to perform critical file comparisons at least weekly.

How is PCI-DSS applicable to SAP systems and applications?

PCI-DSS is applicable to SAP systems and applications because SAP systems are often used to process and store credit card information, and therefore fall under the scope of the standard.

SAP systems have their own set of security requirements, but they must also comply with the specific requirements of PCI-DSS if they are involved in processing, storing, or transmitting credit card data. This includes requirements such as maintaining secure network configurations, implementing access controls, regularly monitoring and testing security systems, and protecting cardholder data through encryption and other means.

SAP provides a range of tools and solutions to help organizations achieve and maintain compliance with PCI-DSS, including pre-configured compliance frameworks, security monitoring tools, and automated reporting capabilities. However, it is ultimately the responsibility of each organization to ensure that their SAP systems and applications meet the specific requirements of the standard.

Meeting these expectations can be difficult, time-consuming, and expensive, but it does not have to be this way for Logpoint users.

Audit support

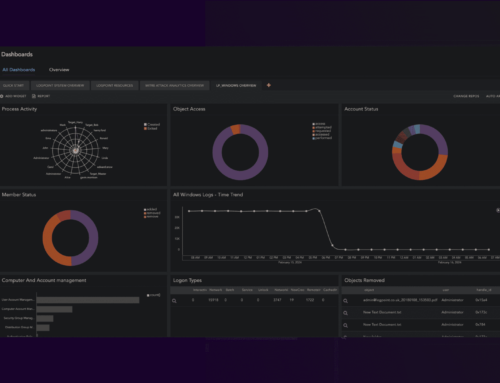

Logpoint SIEM’s native log-retention makes it possible for alert and event information to be stored for later forensic analysis of incidents or suspicious activity. This way, meeting compliance objectives for change audit and log retention, such as the PCI DSS is made significantly easier.

User activity monitoring

User Activity Monitoring has long been the cornerstone of any efficient defence strategy. By design, Logpoint provides analysts with an intuitive and powerful tool to identify malicious activities, create alerts, dashboards and reports, so they can get an overview and counteract immediately.

Primarily for data privacy and regulations, user activity monitoring focuses on activities associated with file access. Logpoint can monitor this using native object access audit records. Additionally, Logpoint’s FIM application monitors any access attempts to privileged file share systems and provides information on the type of access and the actions performed in the file. Additionally, the original and the altered checksums can also be compared to better understand access behavior.