Cybersecurity is an essential practice for safeguarding data within business-critical systems and applications.

Criminals are likely to target the sectors where the biggest potential windfalls are to be gained. Threat actors are constantly looking for ways to gain leverage and use it to their advantage — and the more compromising and sensitive the data, the better.

The security of financial departments and data needs to be a top priority for analysts and CISOs. Typically, financial bodies house some of the most highly prized data in the eyes of criminals, ranging from social security to credit information.

So, how can you implement cybersecurity solutions to counteract threats to the security of financial data?

A good place to start is to familiarize yourself with the issues in the landscape of finance cybersecurity. Let’s take a quick look at the main aspects to be aware of…

Cybersecurity risks for the financial sector

- Ransomware — These attacks look to exploit data gleaned from victims, then demand payment in return for access to the stolen data. Email phishing is a common entry point for ransomware; an unfortunate staff member unwittingly opens a suspicious email and consequently paves the way for criminals to enter the system. This places email security firmly in the spotlight as an area for CISOs and security analysts to focus on.

- Network vulnerability arising from remote working practices — As working patterns continue to shift towards remote structures, the less companies can be sure of their network security. The boundaries of old, such as all staff members working in one office and accessing the internet through proxy servers, are no longer in place and so regulation of working methods has become a juggling act. This situation opens up more potential vulnerabilities for criminals to access data and highlights weak spots within finance cybersecurity.

- Cloud storage systems are becoming more targeted — As someone whose job it is to protect the data of your client or employer, it’s important to understand the shifts in the habits of criminals and to know what they’re likely to focus their attention on. As financial institutions move towards cloud-based storage, threat actors have followed suit.

The vulnerability of your client’s financial data hinges on where it’s stored

Typically, when carrying out a cybersecurity health audit as an analyst or CISO, you’ll need to inspect third-party risks such as SAAS and Cloud systems to see if there are gaps that criminals can exploit.

Given that third-party software is built by a company other than your own and often uses open-source code, the potential for security and stability issues is significant, as evidenced by the Heartbleed Bug back in 2014. A thorough analysis of any third-party software should be performed before it is deployed to help mitigate this risk.

Another aspect to bear in mind is the volume of automation that occurs within your company’s network — wherever processes are connected to the internet, there is the potential for breaches.

To be clear, automation is a crucial tool for streamlining workflows, reducing costs, and implementing cybersecurity solutions, however, when processes are taken out of human hands, there is always the risk of them being exploited or disabled.

This is a particular risk in cloud-based automated solutions. Data stored in the cloud is much more vulnerable to attacks from cybercriminals. It is important to ensure that robust security measures, such as Logpoint’s cloud SIEM integrations, are in place for any processes located in the cloud.

When mechanical processes are automated, as is often seen in manufacturing, there is the potential for any breaches to cause substantial risk to not only expensive equipment but the safety of employees.

In the financial sector, the automation of processes can lead to the removal of human oversight and expose vulnerabilities in the system. An example of this is the automation of maker-checker controls. By removing the human element, you open up critical infrastructure to attack and exploitation.

Maker-checker

Also called 4-eyes or two-man authorization, maker-checker control is a key cornerstone in financial authorization. The basic premise is that each transaction requires at least two individuals’ authorization to be processed:

● The maker — creates the transaction and requests approval

● The checker — approves or denies the request after verification and checking

This dual-authorization approach increases the security, transparency, and visibility of all transactions.

Ask yourself the question, “Do I know how to protect my organization from criminals?”

How Logpoint secures data for financial service departments and their systems and environments

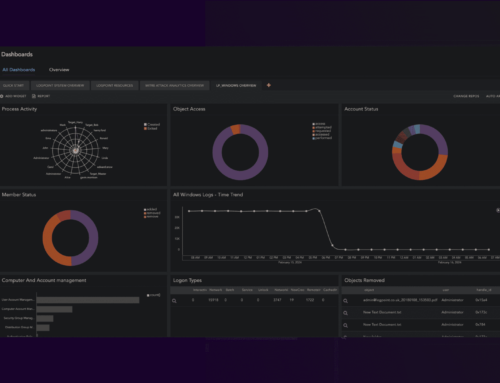

- Logpoint SIEM — Our SIEM system offers in-depth monitoring that ensures you stay on top of the network traffic within your organization.

- Logpoint FIM — Spot suspicious malware activity with our FIM tool. It provides insights into file changes that can reveal malware payload operations.

- User Activity Monitoring — At Logpoint, we give analysts the tools they need to oversee all the activity in their organization’s system. This data is packaged in an easy-to-read format and accessible through a user-friendly dashboard.

- Critical Infrastructure Protection — Improve your financial data security by utilizing a dedicated SAP Security and Compliance tool, such as Logpoint’s BCS for SAP. Amalgamate data from across your system and gather a full spectrum of information together in one place, to make your role as an analyst easier. Advanced analytics and fast response can be limited in business-critical systems, so choose Logpoint to stay ahead of criminal activity.

- NIS2 Compliant — Logpoint offers cybersecurity measures that are in line with the new NIS2 framework. NIS2 is an EU-led protocol that aims to establish a widely used cybersecurity solution to prevent attacks by criminals and enhance resilience.

- PCI-DSS Compliance Support — The Payment Card Industry Data Security Standard (PCI-DSS) provides protection for cardholders’ data against misuse or theft, and compliance is essential for companies handling this kind of data. Meeting the requirements of this standard can be time-consuming and confusing but Logpoint’s platform removes the hard work. Through audit support, user activity monitoring, threat indicator identification, and network monitoring, you can be sure that you always remain compliant with the PCI-DSS.

Logpoint’s unified SIEM, SOAR & UEBA approach accelerates threat detection and helps you to respond rapidly and efficiently. Logpoint also has the only Converged SIEM that collects, analyzes, and prioritizes security incidents. Get in touch today to book a demo and find out how we can take your cybersecurity to the next level.